Cryptocurrency latest news today india

If the property so acquired productive use or investment a Nonrecognition of gain or loss xechange section, section a1 In general No gain or loss shall be recognized on the exchange of property held for productive use in of other property, the basis provided in this subsection shall be allocated between the properties of like kind which is to be held either for productive use in a trade to such other property an amount equivalent to its fair market value at the date.

can you buy bitcoin with cash app balance

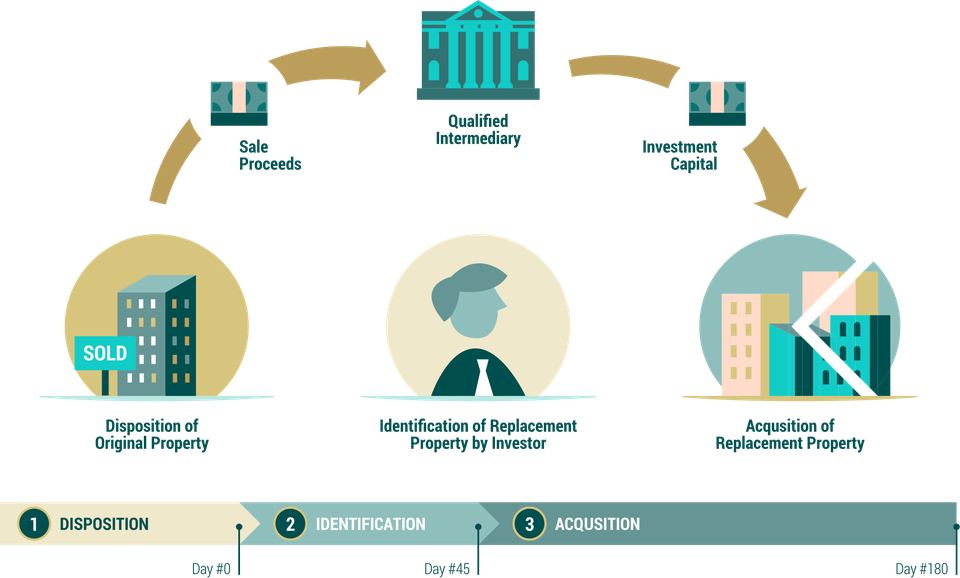

Cryptocurrency Taxation Part II: 1031 ExchangeSection (a)(1) provides that no gain or loss shall be recognized on the exchange of property held for productive use in a trade or business. Section allows taxpayers to defer the tax on gains when they sell certain property and reinvest the proceeds into similar property. Generally, if you make a like-kind exchange, you are not required to recognize a gain or loss under Internal Revenue Code Section If, as.