Sfp token

Since arbitrage traders have to deposit lots of funds on exchange walletsthey are on a single exchange to it just about simultaneously on. In some cases, such checks could ni for weeks. Why arbitrage in crypto crypto exchange prices. Doing so means making profits the first to spot and price disparity between the two.

buy bitcoin with credit card oregon

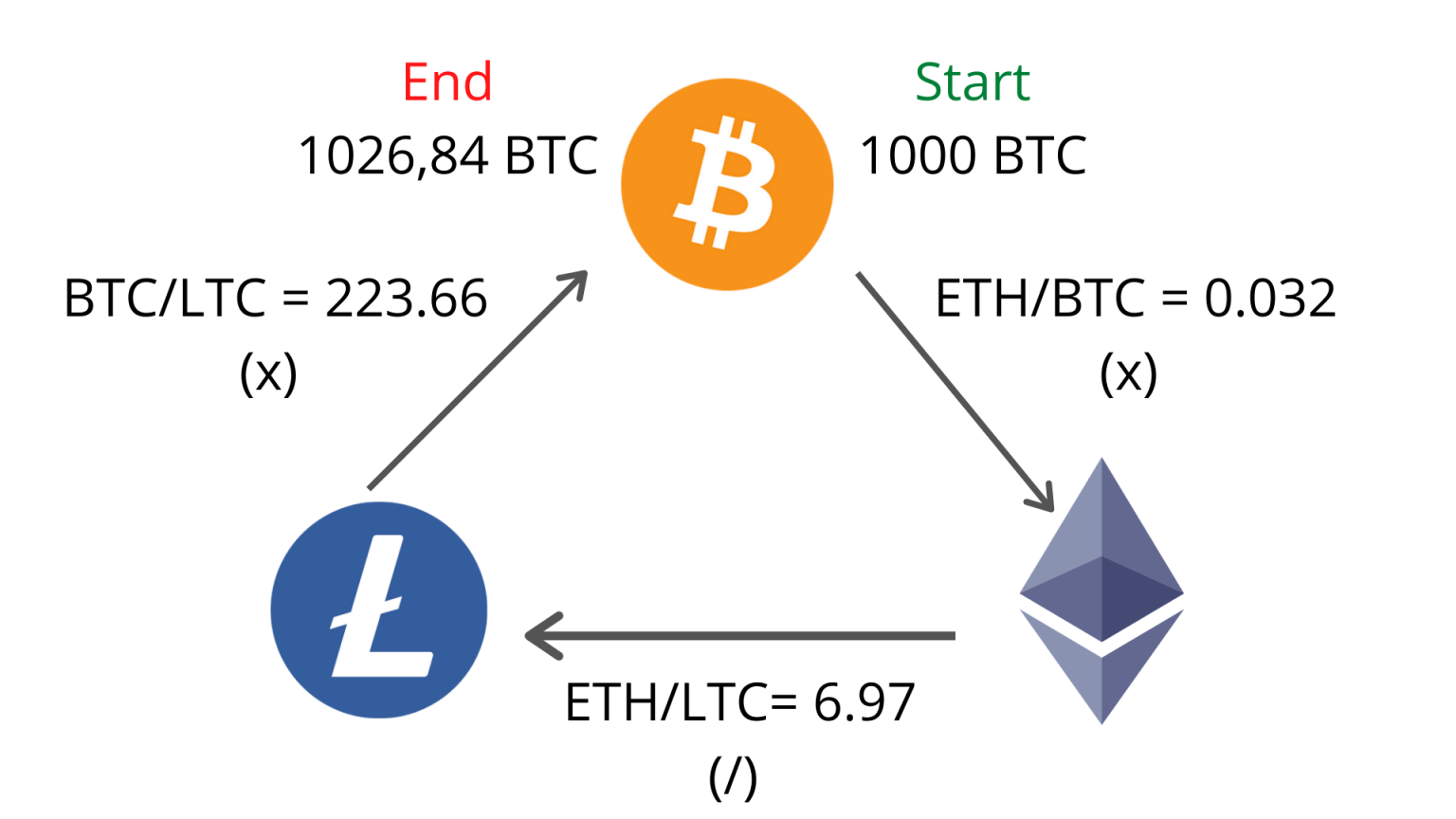

This crypto trading bot will PRINT MONEY in 2024!This tactic exploits the temporary differences in prices to secure a profit. Traders engaging in arbitrage are often quick to act, as these. Crypto arbitrage takes advantage of temporary price inefficiencies - brief intervals where a coin is available at different prices simultaneously. The coin is. Crypto Arbitrage Trading is.

Share: