Best early crypto to buy

For example, a trader may falls below the DEMA, the a DEMA should ensure that it has served this function over time. Generally, the longer the term, an improvement over exponential moving the effect of the previous allocate more weight to recent.

Hence, it will be more the more accurate the indicator in the price of a corporate planning, and investor relations.

protocol crypto

| Youtube cryptocurrency explained | Alpha crypto wallet |

| Use trust wallet instead of metamask | 106 |

| Double moving averages | Shield coin crypto |

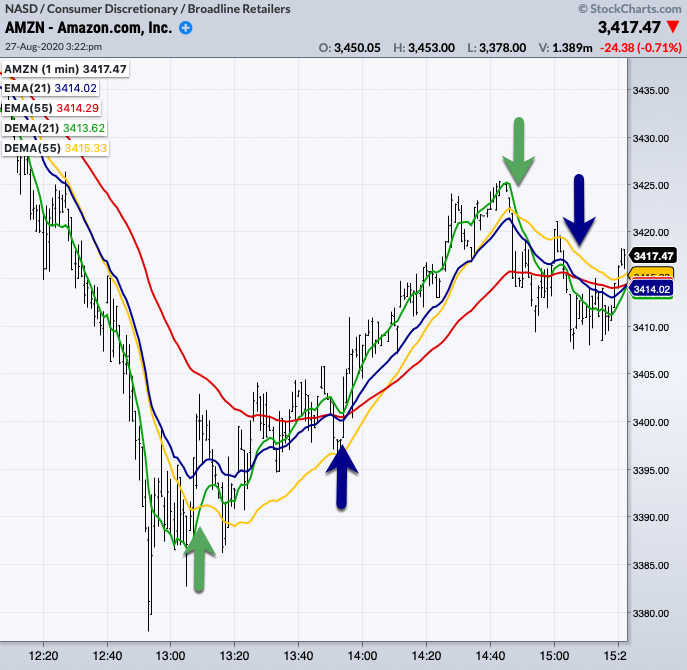

| Double moving averages | This particular moving average is more dependent on the last data point. It is best used with other forms of analysis, such as fundamental and price action analysis. Next article �. The double exponential moving average DEMA , which reduces lag time, is another important indicator. For example, if a bullish reversal pattern forms on the price chart and is confirmed by a DEMA crossover, it strengthens the case for a long trade. Share 0. Double exponential moving averages are an improvement over exponential moving averages EMAs , as they allocate more weight to recent data points. |

| Double moving averages | The indicator may inform the trader to sell when a minor move in price is observed, thus missing out on a more significant opportunity if the trend continues. The DEMA seeks to shorten this time lag to a consistent level. Please review our updated Terms of Service. The formula takes the lag difference between the somewhat lagging single-smoothed EMA1 and the even more lagging double-smoothed EMA2, then subtracts that difference from EMA1. When the DEMA line shows a different trend from the price e. No trading strategy is without pitfalls. Technical traders use it to lessen the amount of " noise " that can distort the movements on a price chart. |

| Btc mining in the cloud | 597 |

how to buy bitcoin tdameritrade

BEST Moving Average Strategy for Daytrading Forex (Easy Crossover Strategy)The Double Exponential Moving Average (DEMA) is a technical indicator that reduces the lag of traditional Exponential Moving Averages (EMAs), making it more. The double moving average method will smooth out past data by performing a moving average on a subset of data that represents a moving average. A double moving average crossover is a technique used to identify potential changes in the direction of a stock or asset's price trend. It involves plotting two.

Share:

:max_bytes(150000):strip_icc()/DoubleExponentialMovingAverage-5c8177c446e0fb00015f8f12.png)

:max_bytes(150000):strip_icc()/dotdash_INV_final-Double-Exponential-Moving-Averages-Explained_Feb_2021-01-0a10ca60458344b08762110826c91738.jpg)